|

TEXAS ETHICS COMMISSION |

|

ETHICS ADVISORY OPINION NO. 606

June 18, 2024

ISSUE

Whether a Texas Limited Liability Company that is a wholly-owned subsidiary of a Master Limited Partnership that is traded on the New York Stock Exchange is prohibited by Chapter 253 of the Election Code from making certain political contributions. (AOR-693).

SUMMARY

A Texas Limited Liability Company that is owned by a partnership whose shares are publicly-traded on an exchange is subject to the Chapter 253 corporate contribution prohibition if any share of the partnership is owned by a corporation.

FACTS

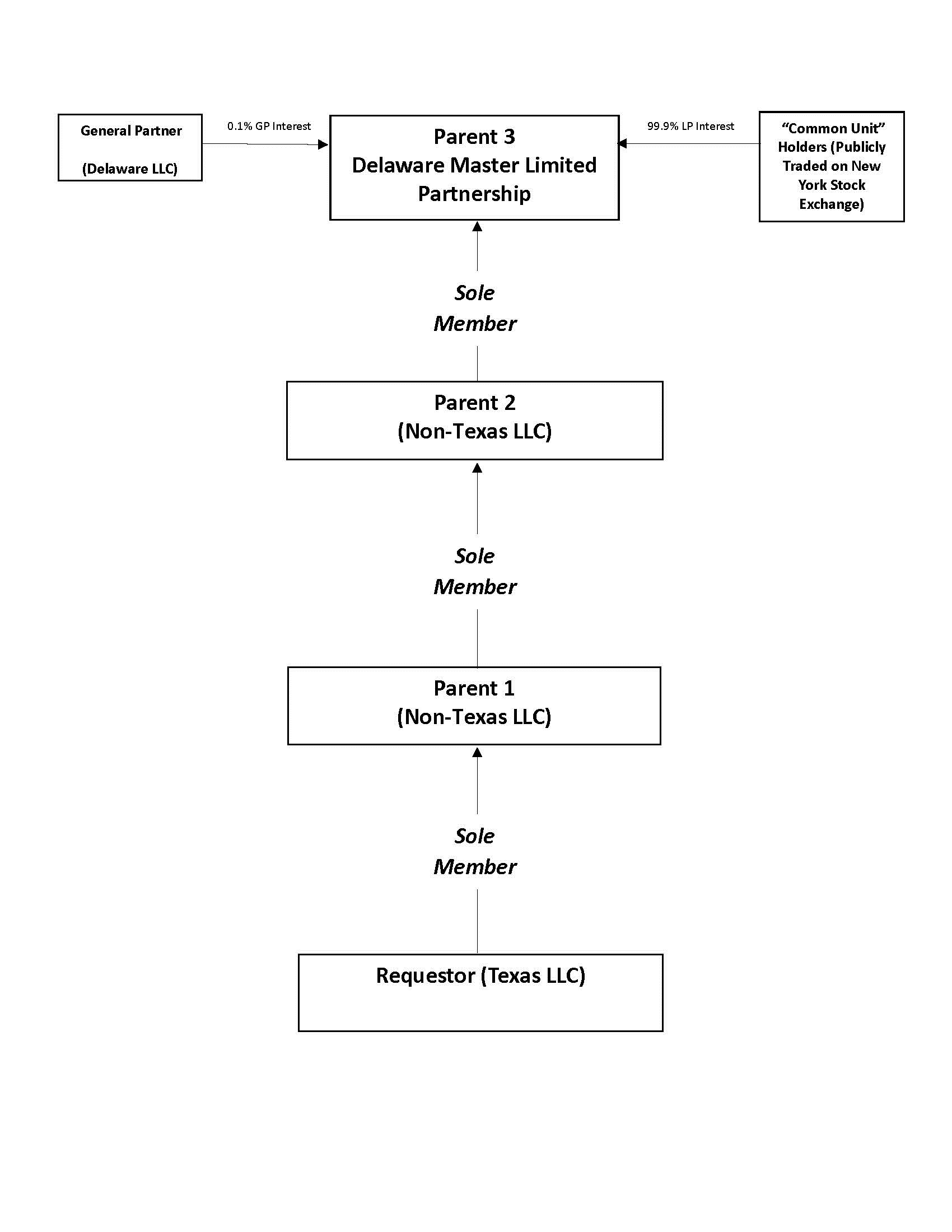

The requestor is a Texas Limited Liability Company formed under the Texas Limited Liability Company Act and is managed by its sole member, which is another LLC (Parent 1).

Parent 1 is an LLC formed under a different state’s laws and is managed by its sole member, another LLC (Parent 2).

Parent 2 is an LLC formed under a different state’s laws and is managed by its sole member, another LLC (Parent 3).

Parent 3 is a Delaware Master Limited Partnership. Parent 3 was formed under the Delaware Revised Uniform Partnership Act and is managed by its different LLC that serves as its general partner (General Partner). The chain of ownership is illustrated below.

Parent 3 is a master limited partnership. A “master limited partnership is a limited partnership whose interests, called ‘common units,’ are publicly traded.” Williams v. Pipe Pros, LLC, No. 6:20-CV-00057, 2021 U.S. Dist. LEXIS 46406, at *3 n.2 (S.D. Tex. 2021) (internal citation omitted). “Master limited partnerships are similar to traditional limited partnerships in that they have limited partners, known as ‘unitholders,’ who provide capital, and a general partner who manages the partnership's affairs. Such partnerships differ, however, from traditional limited partnerships in that master limited partnerships are publicly traded.” Id.

The requestor states the board of directors of the General Partner has ultimate management authority over the General Partner, and the entire chain of entities, including the requestor. All of the General Partner’s board members are individuals.

ANALYSIS

The Texas Election Code generally prohibits corporations from making political contributions or expenditures. Tex. Elec. Code § 253.094. The corporate contribution restriction does not apply to all business forms. Instead it “applies only to corporations that are organized under the Texas Business Corporation Act, the Texas For-Profit Corporation Law, the Texas Non-Profit Corporation Act, the Texas Nonprofit Corporation Law, federal law, or law of another state or nation.” Id. § 253.091. The prohibition also applies to the following associations, whether incorporated or not, including: banks, trust companies, savings and loan associations or companies, insurance companies, reciprocal or inter insurance exchanges, railroad companies, cemetery companies, government-regulated cooperatives, stock companies, and abstract and title insurance companies. Id. § 253.093.

The question often arises, as it does here, whether a business association that is not organized as a corporation is nevertheless subject to the corporate contribution restriction if it has corporate ownership.

In Advisory Opinion No. 215 the TEC held that a “partnership including one or more corporate partners is subject to the same restrictions on political activity that apply to corporations.” Tex. Ethics Comm’n Op. No 215 (1994), affirmed by Tex. Ethics Comm’n Op. No. 221 (1994). The TEC reasoned that “if a joint venture owned in part by a corporation made political contributions, corporate funds would be used to finance political activity.” Id.

In EAO 221, the TEC was asked to reconsider EAO 215 under the following facts:

- (a) the corporate partners play no decision making role in, or exercise any control over . . . political contributions/expenditures;

- (b) the non-corporate agent or employee of the partnership exercising control over such political contributions/expenditures is not an officer, employee or agent of any of the corporate partners;

- (c) contributions/expenditures are made only from partnership profits and not from contributions from corporate partners;

- (d) there are valid business reasons for the use of the partnership entity by the corporate partners and such use is not merely a subterfuge for circumvention of section 253.094 of the Election Code; and

- (e) the partnership is not an association described in Section 253.093 of the Texas Election Code.

Tex. Ethics Comm’n Op. No. 221 (1994). The TEC found that “[n]one of the factors listed above would permit a partnership with corporate partners to make political contributions or expenditures.” Id. The TEC similarly held that a limited liability company is subject to the corporate contribution restriction if it “is owned, in whole or in part, by an entity subject to the restrictions in Election Code chapter 253, subchapter D.” Tex. Ethics Comm’n Op. No 383 (1997).

The requestor is wholly owned by a master limited partnership that is organized as a Delaware limited partnership under the Delaware Revised Uniform Partnership Act. The Master Limited Partnership (“MLP”) is traded daily on the New York Stock Exchange. Anyone—including corporations—may buy or sell units of the MLP. Ownership interest in the MLP changes daily.

Following the TEC’s past decisions, any amount of corporate ownership of an LLC will subject the LLC to the corporate contribution restriction. Applying that precedent to this request compels the conclusion that state law prohibits the requestor from making political contributions if any share of the MLP is owned by a corporation.