SPAC Page Help

Specific-Purpose Committee Campaign Finance Report

0.1.0

SPAC: Manage My Profile – Maintain Addresses

This screen displays a table with the address information currently on file with the Texas Ethics Commission (TEC) for your filer account. If you have filed a campaign treasurer appointment (Form STA) with the TEC, the current treasurer's address information and assistant treasurer's address information, if applicable, is also displayed. The TEC will use this address information to send you correspondence that cannot be sent by email. Please note: It is important for you to keep this information up-to-date so that you do not miss any notices regarding your filing requirements.

Any changes you make to your filer or treasurer address(es) in the filing application will also update your information on file with the TEC. You may provide up to three addresses (Mailing, Street and Other) for the filer, treasurer, and assistant treasurer, if any. To add a new address, click the

Addresses on SPAC Reports: The addresses marked with an asterisk (*) in the address table on this screen will be entered on the reports you file using this filing application. The address you enter as the Filer Mailing Address will be used for the "Committee Address" on the Cover Sheet of your reports. The address you enter as the Treasurer Street Address will be used for the "Campaign Treasurer Street Address" and the Treasurer Mailing Address will be used for the "Campaign Treasurer Mailing Address" on the Cover Sheet of your reports.

SPAC: Manage My Profile – Address Entry

Please note: It is important for you to keep this information up-to-date so that you do not miss any notices regarding your filing requirements.

Any changes you make to your filer or treasurer address(es) in the filing application will also update your information on file with the TEC. You may provide up to three addresses (Mailing, Street and Other) for the filer, treasurer, and assistant treasurer, if any.

Editing an Address:

Filer/Treasurer/Chair (Display Only): This information may not be edited. The person (Filer, Treasurer, or Assistant Treasurer) whose address you are editing is displayed, based on your selection on the "Maintain Addresses" screen.

Address Type (Display Only): This information may not be edited. The general type (Mailing, Street, or Other) of the address you are editing is displayed, based on your selection on the "Maintain Addresses" screen.

Address (Street Address 1, Street Address 2, City, Country, State, Zip Code): Enter the complete address for the displayed person and address type. If you are entering a Mailing address, use the Street Address 1 field to enter a P.O. Box.

Adding an Address:

Filer/Treasurer/Chair: Only valid choices are shown in the drop down list. If your committee does not have an assistant campaign treasurer on file, then you will not see Assistant Treasurer as a valid choice. Select the type of person for which the address you are adding applies:

Address Type: Only valid choices (address types not currently on file) are shown in the drop down list as available to add. You must have at least one address for the filer. You must also have at least one address for the treasurer. You may also provide additional addresses as back-up contact information. You may provide a maximum of three addresses for each person.

SPAC: Manage My Reports

Click on the Start a New Report button to start a new report for an upcoming deadline. Based on several factors (including today's date, your filing records in the TEC database, and the filing schedule), the filing application will suggest the next report it appears you are required to file. Then you will have the opportunity to start the suggested report or start a different report by clicking on the Other Report Options button.

Other Report Options:

•

•

•

•

In-Progress Reports shows you the following information about the report(s) you have started in the TEC filing application but have not yet filed:

You may also click on the Print button to print a copy of an in-progress report in PDF format or click on the Delete button to delete an in-progress report. Note: If you click "Delete" you will be asked "Are you sure?" and have a chance to confirm your action. If you click "yes" to confirm, the entire report will be deleted and unrecoverable.

You may also click on the Upload File button if you entered your contribution or expenditure data in a separate spreadsheet and need to upload the file into an in-progress report in the TEC filing application. For more information, see the Import/Export Guide.

Missing/Late Reports shows you the following information about the report(s) that, according to TEC records, you were required to file with the TEC by a certain deadline but have not yet filed. Note: You may be subject to a late-filing penalty (late fine) for a required report that is not filed by the filing deadline.

Filed Reports shows you the following information about the report(s) you have successfully filed with the TEC:

If you discover an error or omission in a filed report, you may click on the Correct/Update button to start a Corrected Report. Once you start a Corrected Report, that action button will be removed but the original report will continue to display in your Filed Reports list. If you start a Corrected Report and need more than one entry session to complete and file it, the Corrected Report will appear in your In-Progress Reports list for you to continue working on the next time you return to this screen.

If you filed a report after the filing deadline, you may be subject to a late fine. If you need to pay a late fine for a filed report, you may click on the Pay Fine button next to the applicable report to access the electronic payment screen.

SPAC: Cover Sheet – Report Type & Period Covered

What kind of report do you want to file? (Report Type): You can only select one of these report types for this report. If you need to file more than one of these report types, you must file each as a separate report. You can select one of the following report types as a stand-alone report or in combination with the "Dissolution" or "10th Day After Campaign Treasurer Termination" reports below, if applicable. Read the information concerning each of the report types. Select the radio button for the report type that applies to the event for which you are filing.

January 15th Semiannual Report: All specific-purpose committees must file a semiannual report. A report filed with the TEC is due by midnight Central Time on the January 15th due date.

July 15th Semiannual Report: All specific-purpose committees must file a semiannual report. A report filed with the TEC is due by midnight Central Time on the July 15th due date.

30th Day Before Election Report: Specific-purpose committees that are supporting or opposing an opposed candidate or a measure in an election and did not choose the modified reporting schedule must file this pre-election report. If your committee chose modified reporting, but then exceeded the Modified Reporting Limit before the 30th day before the election, your committee must file this report. (Note: Specific-purpose committees that support or oppose a candidate who is unopposed in an election are not required to file pre-election reports for that election.) The report is due no later than 30 days before the election and must be received by the appropriate filing authority no later than the report due date. A report filed with the TEC is due by midnight Central Time on the due date.

8th Day Before Election Report: Specific-purpose committees that are supporting or opposing an opposed candidate or a measure in an election and did not choose the modified reporting schedule must file this pre-election report. If your committee chose modified reporting, but then exceeded the Modified Reporting Limit in contributions or expenditures, before the 8th day before the election, your committee must file this report. (Note: Specific-purpose committees that support or oppose a candidate who is unopposed in an election are not required to file pre-election reports for that election.) If your committee filed the “30th Day Before Election Report,” then your committee must file this report. The report is due no later than 8 days before the election and must be received by the appropriate filing authority no later than the report due date. A report filed with the TEC is due by midnight Central Time on the due date.

Exceeded Modified Reporting Limit Report Period: Candidates who chose to file under the modified reporting schedule but then, after the 30th day before the election, exceeded the Modified Reporting Limit in contributions or in expenditures in connection with the election must file this Exceeded Modified Reporting Limit report within 48 hours after exceeding the Modified Reporting Limit.

Runoff Report: Specific-purpose committees that are supporting or opposing a candidate in a runoff election and did not choose the modified reporting schedule must file this runoff report. The report is due no later than 8 days before the runoff election and must be received by the appropriate filing authority no later than the report due date. A report filed with the TEC is due by midnight Central Time on the due date.

Less Commonly Filed Reports: These reports are only required if you meet certain criteria. You can select one of the following report types as a stand-alone report or in combination with one of the reports listed above, if applicable. Select the radio button for one of these less commonly filed reports only if the report type applies to the event for which you are filing.

Dissolution Report: You must file a Dissolution report in order to dissolve the committee. Your committee may file a Dissolution report if your committee expects to have no further reportable activity. There is not a fixed deadline for this report. A Dissolution report terminates the appointment of campaign treasurer and relieves the campaign treasurer of the duty to file additional reports. (In this case, the Dissolution report serves as the treasurer's termination report.)

10th Day After Campaign Treasurer Termination Report: A specific-purpose committee’s campaign treasurer must file this report if his or her campaign treasurer appointment is terminated. This report is due no later than the 10th day after the termination is filed. If the termination takes place on the last day of a reporting period and the proper report for that period is filed, no separate termination report is required.

Other Reports: These other reports are only required in certain circumstances and cannot be combined with other report types. Read the information concerning each of the report types. Select the radio button for one of these other reports only if the report type applies to the event for which you are filing.

Daily Pre-election Report of Contributions: Daily Pre-election reports are time-sensitive reports due during the period beginning the 9th day before an election and ending at 12 noon on the day before the election. If your specific-purpose committee supports or opposes a candidate for statewide office, district office filled by voters of more than one county, judicial district office filled by voters of only one county, State Board of Education, state senator, or state representative, your committee is required to file a Daily Pre-election report each time your committee accepts contribution(s) from a single source that in the aggregate total more than that in the aggregate exceed the Contribution Limit during the Daily reporting period.

Your committee may be required to file more than one Daily report during the Daily report period. A Daily report must be received by the TEC no later than midnight Central Time the first business day after the date your committee accepted the contribution that triggered the reporting requirement.

Legislative Special Session Report: This report is filed after a special legislative session called by the governor. You must file this report ONLY IF your specific-purpose committee supports, opposes, or assists a statewide or legislative candidate or officeholder, and your committee accepted contributions during the period covered by the Special Session report. (Specific-purpose committees that support, oppose, or assist a statewide officeholder or member of the legislature may not accept political contributions during a regular legislative session. This restriction does not apply during a special session.) The Special Session report must be filed no later than 30 days after the date of final adjournment and must cover the period beginning on the date the governor signs the proclamation calling the special session and ending on the date of final adjournment of the special session. You are not required to file a separate Special Session report if another report is due no later than the 10th day after the date on which the Special Session report would be due.

If your committee does not accept any contributions during the period covered by the Special Session report, you are not required to file the report. (This is an exception from the usual requirement that you must file a report even if you have no activity to report.)

A Special Session report is a report of contributions only, not expenditures. Contributions reported on a Special Session report must be reported again on your next regular report. (Don't worry; the filing application will automatically copy contributions from any Special Session report you file into your next required report.) In addition, you must include on your next regular report any expenditures that occurred during the period covered by the Special Session report.

Period Covered: The filing application will calculate the period covered for your report based on the report type you select. You can modify the start and end dates as long as your modified start date does not precede the filing application calculated start date and your modified end date does not extend past the filing application calculated end date. If you need to report activity outside of the filing application calculated date range for this report, you will need to file multiple reports.

A reporting period includes the Start date and the End date. The report due date will be after the end of the period. Generally, a report picks up where the last report left off and there should be no gaps or overlapping periods. The exceptions are Daily Pre-election reports and Special Session reports, which do create overlaps because you are required to report the activity twice.

First Reports. If this is the first campaign finance report that your committee has filed, the start date will be the date your committee's campaign treasurer appointment (Form STA) was filed.

SPAC: Cover Sheet – Election Information

Election Information: (If your specific-purpose committee accepted contributions or made expenditures in connection with an upcoming election or a recently held election, provide the election information. If your committee has not participated in a recently held election and does not intend to participate in an upcoming election, this section does not apply to you.)

SPAC: Cover Sheet – Committee Purpose

Committee Purpose: Your specific-purpose committee is required to identify each candidate or ballot measure supported or opposed and each officeholder assisted by the committee in this reporting period. Note: This information should also have been included on your committee's campaign treasurer appointment (Form STA). If there is a change in this information, you must file an amended campaign treasurer appointment (Form ASTA) to report the change within 24 hours of the change.

Changing Status? Sometimes a specific-purpose political committee (SPAC) is organized to support a particular candidate or measure but later broadens its goals to support a variety of candidates who share the group's views on a particular issue or to support a variety of measures related to an issue. In that case, the committee has become a general-purpose political committee (GPAC). Tell Me More About Committees Changing Status

Candidate or Officeholder Information: (These fields will be activated only if “Candidate” or “Officeholder” is selected for the Subject of your committee’s activity.)

Candidate or Officeholder Name (First, Last, Title, Suffix, or Nickname): Enter the full name, first, last, and suffix (Jr., III, etc.) if applicable (Title and Nickname are optional).

Measure Information: (These fields will be activated only if “Measure” is selected for the Subject of your committee’s activity.)

SPAC: Worksheet Summary

Worksheet Summary is a new page in the filing application designed to help you keep track of the schedules required for this report and the activity you enter. If you indicated by answering "Yes" on the previous Reporting Period Activities screen that your committee has activity to report, those schedules/categories are highlighted in green in the grid.

Worksheet Summary Grid: The reporting schedules/categories are organized into three main areas:

•

•

•

Under each main area, the information is displayed in the following columns:

Walk Thru: Click this link to be guided through a series of questions to help you determine whether or not your committee may have activity to disclose on a particular report schedule. This option allows you to walk-through a single schedule only. During the walk-through, if you choose to "work on this later" the schedule will be flagged with a check mark in the

SPAC: Schedule A1

Schedule A1 is used to itemize incoming monetary political contributions that exceed the Itemization Threshold from one person during the reporting period.

If your committee accepted other types of incoming funds (such as loans or interest) or non-monetary contributions (such as in-kind contributions or pledges), enter them on the applicable schedules associated with the categories shown on the Worksheet Summary page.

Notice to Candidates and Officeholders: If committee makes political expenditures or accepts political contributions in support of a candidate or officeholder, your committee must provide written notice to the candidate or officeholder who benefits from the committee's activity. The notice must be given before the end of the reporting period during which your committee made the political expenditures or accepted the political contributions. The notice must inform the person that the committee has made political expenditures or accepted political contributions on his or her behalf, and it must include the full name and address of the political committee and its campaign treasurer and an indication that the committee is a specific-purpose committee. NOTE: Such notices are not required if the committee is the principal political committee of a political party.

Corporate or Labor Organization Contributions or Support: Do not enter on this schedule contributions or support your committee received from corporations or labor organizations. A specific-purpose committee that supports or opposes measures exclusively may accept monetary and non-monetary (in-kind) contributions from corporations or labor organizations and must report such contributions on Schedules C1, C2, and D. If a committee supports or opposes a candidate or assists an officeholder, the committee may not accept corporate or labor organization contributions.

Contributions List: After you enter and save your first contribution, the filing application will begin a list of all contributions entered on Schedule A1 for this report. The list will display columns showing pertinent information for each contribution:

The contribution list will be the first screen you see each time you return to this schedule. From this list, you will be able to

Contributions from Out-of-State Political Committees (These fields will be activated only if "Entity" is selected for the type of contributor.)

Is the Contributor an out-of-state PAC? Check this box only if the contributor is an out-of-state political committee (PAC). Certain restrictions apply to contributions from out-of-state PACs. The fact that a political committee has a mailing address outside of Texas does not mean that the committee is an out-of-state PAC for purposes of these restrictions. A political committee that has a campaign treasurer appointment on file in Texas is NOT an out-of-state PAC. A political committee that makes most of its political expenditures outside of Texas may be an out-of-state PAC. A political committee must determine if it is an out-of-state PAC.

PAC FEC #: If the out-of-state PAC is registered with the Federal Election Commission (FEC), enter the PAC’s FEC identification number (FEC #).

If you do not have an FEC # for the out-of-state PAC, you must provide other documentation as explained below.

Browse to Upload PDF. Attach a copy of one of the following required documents in PDF format to be included with your report:

There are thresholds for contributions from an out-of-state PAC (including pledges or loans from sources other than financial institutions that have been in business for more than a year), that, if exceeded, trigger additional reporting requirements.If you accept

• a copy of the out-of-state PAC’s statement of organization filed as required by law with the Federal Election Commission (FEC) and certified by an officer of the out-of-state PAC; or

• a written statement, certified by an officer of the out-of-state PAC, listing the full name and address of each person who contributed more than the Out-of-state PAC Contributions TO Threshold** amount (see table above) to the out-of-state PAC during the 12 months immediately preceding the contribution.

If you accept

• a copy of the out-of-state PAC’s statement of organization filed as required by law with the Federal Election Commission (FEC) and certified by an officer of the out-of-state PAC; or

• a document listing the committee’s name, address and phone number; the name of the person appointing the committee’s campaign treasurer; and the name, address and phone number of the committee’s campaign treasurer.

NOTE: If your committee accepted contributions from an out-of-state PAC and you do not enter the FEC # or attach a PDF copy of the required information, you must timely file a paper copy of the required information at the time you file your electronic report.

Itemize box: Checking this box indicates that this contribution will be itemized on Schedule A1. The automatic default is to itemize. You are required to itemize contributions made electronically and itemize contributions that exceed the Itemization Threshold (in the aggregate) from a single contributor. If you accepted two or more contributions from the same contributor, the total of which exceeded the Itemization Threshold, enter each contribution separately and be sure the box is checked for each entry.

Contributor Principal Occupation and Employer Information (These fields will be activated only if "Individual" is selected for the type of contributor.)

SPAC: Schedule C1

Enter only incoming monetary corporate or labor organization contributions on Schedule C1. (Non-monetary (in-kind) corporate or labor organization contributions are now entered on Schedule C2).

Schedules C1 and C2 are only for specific-purpose committees that support or oppose measures exclusively. Such committees also use Schedule D to disclose corporate or labor organization pledged contributions. If a committee supports or opposes a candidate or assists an officeholder, the committee may not accept corporate or labor organization contributions.

Schedule C1 is used by political committees that support or oppose measures exclusively to itemize all monetary political contributions accepted from corporations or labor organizations during this reporting period. You must itemize all such corporate or labor organization monetary contributions, regardless of the amount, on this schedule. If your committee accepted other types of incoming funds (such as loans or interest) or non-monetary contributions (such as in-kind contributions or pledges), enter them on the applicable schedules associated with the categories shown on the Worksheet Summary page.

Contributions List: After you enter and save your first corporate or labor organization contribution, the filing application will begin a list of all contributions entered on Schedule C1 for this report. The list will display columns showing pertinent information for each contribution:

The contribution list will be the first screen you see each time you return to this schedule. From this list, you will be able to

Itemize box: This box is always checked on this schedule. Your committee is required to itemize all contributions from corporations and labor organizations, regardless of the amount. If your committee accepted two or more contributions from the same corporate contributor, enter each contribution separately.

SPAC: Schedule E

Schedule E is used to itemize loans made for political purposes by financial institutions or individuals. You must itemize all loans that your committee accepted during the reporting period from financial institutions regardless of the amount.

Additionally, you must itemize loans exceeding the Itemization Threshold from one person that you accepted during the reporting period. The itemization threshold is defined in the "Loan Itemization Thresholds" table above.

NOTE: Only a specific-purpose committee for supporting or opposing measures exclusively may accept a loan from a corporation other than a financial institution.

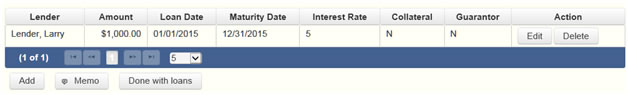

Loans List: After you enter and save your first loan, the filing application will begin a list of all loans entered on Schedule E for this report. The list will display columns showing pertinent information for each loan:

The loans list will be the first screen you see each time you return to this schedule. From this list, you will be able to

Itemize box: Checking this box indicates that this loan will be itemized on Schedule E. The automatic default is to itemize. Your committee is required to itemize all loans from financial institutions, regardless of the amount. Additionally, you must itemize loans exceeding the Itemization Threshold from one person that you accepted during the reporting period. If you accepted two or more loans from the same person, the total of which exceeds the Itemization Threshold, enter each loan separately. You must also itemize loans that are made electronically by a person other than a financial institution. See the loan thresholds in the "Loan Itemization Thresholds" table above.

Loans from Out-of-State Political Committees (These fields will be activated only if "Entity" is selected for the type of lender.)

Is the Lender an out-of-state PAC? Check this box only if the lender is an out-of-state political committee (PAC). Certain restrictions apply to contributions (including loans) from out-of-state PACs. The fact that a political committee has a mailing address outside of Texas does not mean that the committee is an out-of-state PAC for purposes of these restrictions. A political committee that has a campaign treasurer appointment on file in Texas is NOT an out-of-state PAC. A political committee that makes most of its political expenditures outside of Texas may be an out-of-state PAC. A political committee must determine if it is an out-of-state PAC.

PAC FEC #: If the out-of-state PAC is registered with the Federal Election Commission (FEC), enter the PAC’s FEC identification number (FEC #).

If you do not have an FEC # for the out-of-state PAC, you must provide other documentation as explained below.

Browse to Upload PDF. Attach a copy of one of the following required documents in PDF format to be included with your report:

If you accept

• a copy of the out-of-state PAC’s statement of organization filed as required by law with the Federal Election Commission (FEC) and certified by an officer of the out-of-state PAC; or

• a written statement, certified by an officer of the out-of-state PAC, listing the full name and address of each person who contributed more than the Out-of-state PAC Contributions TO Threshold** to the out-of-state PAC during the 12 months immediately preceding the contribution.

If you accept

• a copy of the out-of-state PAC’s statement of organization filed as required by law with the Federal Election Commission (FEC) and certified by an officer of the out-of-state PAC; or

• a document listing the committee’s name, address and phone number; the name of the person appointing the committee’s campaign treasurer; and the name, address and phone number of the committee’s campaign treasurer.

NOTE: If your committee accepted loans from an out-of-state PAC and you do not enter the FEC # or attach a PDF copy of the required information, you must timely file a paper copy of the required information at the time you file your electronic report.

Lender Principal Occupation and Employer Information (These fields will be activated only if "Individual" is selected for the type of lender.)

SPAC: Schedule E – Guarantor Entry

Note: A person who guarantees all or part of a loan makes a reportable contribution in the amount of the guarantee. You must report such a contribution here under "Guarantor Information" on Schedule E, and not on the contributions schedule.

SPAC: Schedule K

Schedule K is used to itemize certain types of incoming funds that you received during the reporting period. There are specific itemization thresholds for reporting these incoming funds:

Schedule K is used to itemize the following types of incoming funds that you received during the reporting period:

• Any credit, interest, rebate, refund, reimbursement, or return of a deposit fee resulting from the use of a political contribution or an asset purchased with a political contribution, the amount of which exceeds the Itemization Threshold as stated in the "Schedule K Itemization Thresholds" table;

• Any proceeds of the sale of an asset purchased with a political contribution, the amount of which exceeds the Itemization Threshold as stated in the "Schedule K Itemization Thresholds" table;

• Any other gain from a political contribution, the amount of which exceeds the Itemization Threshold as stated in the "Schedule K Itemization Thresholds" table; and

• Any political contributions previously made to a candidate, officeholder, or another political committee that were returned to your committee during the reporting period.

Although you are not required to do so, you may also itemize on Schedule K any credit, gain, refund, or interest that does not exceed the Itemization Threshold as stated in the "Schedule K Itemization Thresholds" table. Contributions returned to your committee must be itemized regardless of the amount of the contribution. Unlike other schedules, you are NOT required to enter a lump sum total of unitemized Schedule K activity on the Schedule Subtotals page of this report.

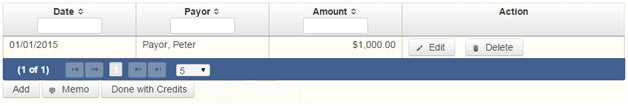

Credits List: After you enter and save your first credit/gain/refund/returned contribution or interest, the filing application will begin a list of all credits/gains/refunds/returned contributions or interest entered on Schedule K for this report. The list will display columns showing pertinent information for each credit/gain/refund/returned contribution or interest:

The credits list will be the first screen you see each time you return to this schedule. From this list, you will be able to

Itemize box: The automatic default is to itemize. You are required to itemize any credit, gain, refund, or interest that exceeds the Itemization Threshold as stated in the "Schedule K Itemization Thresholds" table. If your committee received two or more credits, gains, refunds, or interest from the same person, the total of which exceeded the Itemization Threshold as stated in the "Schedule K Itemization Thresholds" table, enter each credit, gain, refund, or interest separately.

"Check if political contribution returned to filer" box: If this incoming credit/gain was originally made by your committee in the form of a political contribution to a candidate, officeholder, or another political committee and was returned to your committee in this reporting period, check this box.

SPAC: Schedule F1

Effective September 1, 2015, you must disclose committee expenditures charged to a credit card on Schedule F4 and not on this schedule. When your committee uses political contributions to pay the credit card bill, you will disclose the payment to the credit card company on the appropriate disbursements schedule. See Expenditures Made by Credit Card for more information.

Schedule F1 is used to itemize outgoing political payments made from political contributions that exceed the Expenditure Threshold to one individual or entity during the reporting period.

If your committee had other types of outgoing funds or activity (such as investment purchases or unpaid incurred expenditure obligations), or expenditures made by credit card, enter them on the applicable schedules associated with the categories shown on the Worksheet Summary page.

Notice to Candidates and Officeholders: If your committee makes political expenditures or accepts political contributions in support of a candidate or officeholder, your committee must provide written notice to the candidate or officeholder who benefits from the committee's activity. The notice must be given before the end of the reporting period during which your committee made the political expenditures or accepted the political contributions. The notice must inform the person that the committee has made political expenditures or accepted political contributions on his or her behalf, and it must include the full name and address of the political committee and its campaign treasurer and an indication that the committee is a specific-purpose committee. NOTE: Such notices are not required if the committee is the principal political committee of a political party.

Important Restrictions Regarding The Use Of Political Funds To Rent Or Purchase Real Property

Reporting Tips to Avoid Common Pitfalls: Outgoing Expenditures

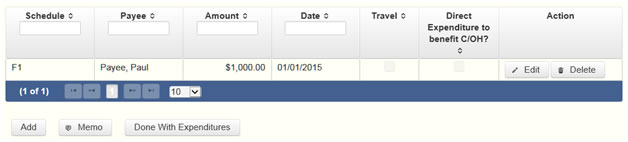

Political Expenditures List: After you enter and save your first political expenditure, the filing application will begin a list of all political expenditures entered on Schedule F1 for this report. The list will display columns showing pertinent information for each payee:

The political expenditures list will be the first screen you see each time you return to this schedule. From this list, you will be able to

Itemize box: Checking this box indicates that this payment will be itemized on Schedule F1. The automatic default is to itemize. Your committee is required to itemize payments that exceed the Expenditure Threshold (in the aggregate) to a single payee. If your committee made two or more political payments to the same payee, the total of which exceeded the Expenditure Threshold, enter each payment separately and be sure the box is checked for each entry.

Expenditure Purpose. You must disclose the purpose of the expenditure in two parts: Category and Description. Merely disclosing the category of goods, services, or other thing of value for which the expenditure is made does not adequately describe the purpose of an expenditure.

Examples of Acceptable Ways to Report Expenditure Purpose

SPAC: Schedule H

Schedule H is used to itemize outgoing payments from political contributions that your specific-purpose committee made to a business in which a candidate supported by your committee or an officeholder assisted by your committee has one or more of the following interests or positions:

1) a participating interest of more than 10%;

2) a position on the governing body of the business;

3) a position as an officer of the business.

Expenditures Made By Credit Card: Effective September 1, 2015, you must disclose committee expenditures charged to a credit card on Schedule F4 and not on this schedule. When your committee uses political contributions to pay the credit card bill, you will disclose the payment to the credit card company on the appropriate disbursements schedule. See Expenditures Made by Credit Card for more information.

Itemize such payments on this Schedule H and not on Schedule F1 (used for monetary political expenditure payments). If your committee had other types of outgoing funds or activity (such as investment purchases, other political expenditures, or unpaid incurred expenditure obligations), enter them on the applicable schedules associated with the categories shown on the Worksheet Summary page.

Important Restrictions Regarding Payments To A Business Of The Candidate Or Officeholder

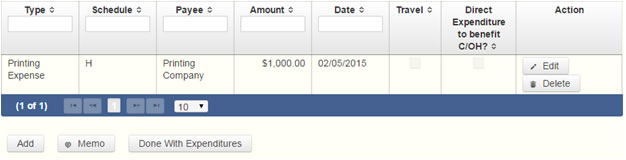

Payment from Political Contributions to Business of C/OH List: After you enter and save your first payment, the filing application will begin a list of all payments entered on Schedule H for this report. The list will display columns showing pertinent information for each payee:

The payments from political contributions to a business of C/OH list will be the first screen you see each time you return to this schedule. From this list, you will be able to

Itemize box: The box is always checked on this schedule. You are required to itemize payments from political contributions that your committee made to a business in which a candidate or officeholder supported or assisted by your committee has an interest of more than 10%, a position on the governing body, or a position as an officer, regardless of the amount. If your committee made two or more such political payments to the same payee, enter each payment separately.

Expenditure Purpose. You must disclose the purpose of the expenditure in two parts: Category and Description. Merely disclosing the category of goods, services, or other thing of value for which the expenditure is made does not adequately describe the purpose of an expenditure.

Examples of Acceptable Ways to Report Expenditure Purpose

SPAC: Schedule I

Schedule I is used to itemize outgoing non-political payments made from political contributions, regardless of the amount. If your committee had other types of outgoing funds or activity (such as political expenditures, investment purchases, or unpaid incurred expenditure obligations), or expenditures made by credit card, enter them on the applicable schedules associated with the categories shown on the Worksheet Summary page.

NOTE: As a practical matter, very few expenditures made from political contributions are non-political expenditures. For instance, expenditures for administrative expenses, banking fees, and professional dues are typically political expenditures and should not be disclosed on Schedule I. Remember that you may not convert political contributions to personal use.

Expenditures Made By Credit Card: Effective September 1, 2015, you must disclose committee expenditures charged to a credit card on Schedule F4 and not on this schedule. When your committee pays the credit card bill, you will disclose the payment to the credit card company on the appropriate disbursements schedule. See Expenditures Made by Credit Card for more information.

Payments to a Business of Candidate or Officeholder: Do not report on this schedule non-political expenditures from political contributions that your specific-purpose committee made to a business in which a candidate supported by the committee or an officeholder assisted by the committee has a participating interest of more than 10%, a position on the governing body, or a position as an officer. Report those types of expenditures on Schedule H. See the Schedule H Page Help for more information about these types of expenditures.

Non-Political Expenditures List: After you enter and save your first non-political expenditure, the filing application will begin a list of all non-political expenditures entered on Schedule I for this report. The list will display columns showing pertinent information for each payee:

The non-political expenditures list will be the first screen you see each time you return to this schedule. From this list, you will be able to

Itemize box: This box is always checked on this schedule. You are required to itemize all non-political expenditures from political contributions regardless of the amount. If your committee made two or more non-political payments to the same payee, enter each payment separately.

Expenditure Purpose. You must disclose the purpose of the expenditure in two parts: Category and Description. Merely disclosing the category of goods, services, or other thing of value for which the expenditure is made does not adequately describe the purpose of an expenditure.

Examples of Acceptable Ways to Report Expenditure Purpose

SPAC: Schedule F3

Schedule F3 is used to itemize any investment your committee purchased with political funds during the reporting period, the amount of which exceeds the investment Itemization Threshold.

If your committee had other types of outgoing funds or activity (such as political expenditures from political funds or unpaid incurred expenditure obligations), enter them on the applicable schedules associated with the categories shown on the Worksheet Summary page.

Purchased Investments List: After you enter and save your first investment purchased with political contributions, the filing application will begin a list of all purchased investments entered on Schedule F3 for this report. The list will display columns showing pertinent information for each payee:

The purchased investments list will be the first screen you see each time you return to this schedule. From this list, you will be able to

Itemize box: The box is always checked on this schedule. You are required to itemize investments that exceed the Itemization Threshold. If your committee made two or more payments to the same payee to purchase an investment, the total of which exceeded the Itemization Threshold, enter each payment separately.

SPAC: Schedule A2

Schedule A2 is used to itemize incoming non-monetary (in-kind) political contributions of goods, services, or other thing of value that exceed the Itemization Threshold from one person during the reporting period.

If your committee accepted other types of incoming funds or activity (such as pledges, monetary contributions, corporate or labor organization contributions or support, loans, or interest) enter them on the applicable schedules associated with the categories shown on the Worksheet Summary page.

Notice to Candidates and Officeholders: If your committee makes political expenditures or accepts political contributions in support of a candidate or officeholder, your committee must provide written notice to the candidate or officeholder who benefits from your committee's activity. The notice must be given before the end of the reporting period during which your committee made the political expenditures or accepted the political contributions. The notice must inform the person your committee has made political expenditures or accepted political contributions on his or her behalf, and it must include the full name and address of the political committee and its campaign treasurer and an indication that the committee is a specific-purpose committee. NOTE: Such notices are not required if the committee is the principal political committee of a political party.

Corporate or Labor Organization Contributions or Support: Do not enter on this schedule contributions or support your committee received from corporations or labor organizations. Only a specific-purpose committee that supports or opposes measures exclusively may accept monetary and non-monetary (in-kind) contributions from corporations or labor organizations and must report such contributions on Schedules C1, C2, and D. If a committee supports or opposes a candidate or assists an officeholder, the committee may not accept corporate or labor organization contributions.

Contribution of Personal Services or Travel: You are not required to include contributions of an individual’s personal services or travel if the individual receives no compensation from any source for the services.

Non-Monetary Contributions List: After you enter and save your first non-monetary (in-kind) contribution, the filing application will begin a list of all contributions entered on Schedule A2 for this report. The list will display pertinent information for each contribution:

The non-monetary contributions list will be the first screen you see each time you return to this schedule. From this list, you will be able to

Contributions from Out-of-State Political Committees (These fields will be activated only if "Entity" is selected for the type of contributor.)

Is the Contributor an out-of-state PAC? Check this box only if the contributor is an out-of-state political committee (PAC). Certain restrictions apply to contributions from out-of-state PACs. The fact that a political committee has a mailing address outside of Texas does not mean that the committee is an out-of-state PAC for purposes of these restrictions. A political committee that has a campaign treasurer appointment on file in Texas is NOT an out-of-state PAC. A political committee that makes most of its political expenditures outside of Texas may be an out-of-state PAC. A political committee must determine if it is an out-of-state PAC.

PAC FEC #: If the out-of-state PAC is registered with the Federal Election Commission (FEC), enter the PAC’s FEC identification number (FEC #).

If you do not have an FEC # for the out-of-state PAC, you must provide other documentation as explained below.

Browse to Upload PDF. Attach a copy of one of the following required documents in PDF format to be included with your report:

There are thresholds for contributions from an out-of-state PAC (including pledges or loans from sources other than financial institutions that have been in business for more than a year), that, if exceeded, trigger additional reporting requirements.

If you accept

• a copy of the out-of-state PAC’s statement of organization filed as required by law with the Federal Election Commission (FEC) and certified by an officer of the out-of-state PAC; or

• a written statement, certified by an officer of the out-of-state PAC, listing the full name and address of each person who contributed more than the Out-of-state PAC Contributions TO Threshold** to the out-of-state PAC, as defined in the "Out-of-State PAC Contribution Thresholds" table above, during the 12 months immediately preceding the contribution.

If you accept

• a copy of the out-of-state PAC’s statement of organization filed as required by law with the Federal Election Commission (FEC) and certified by an officer of the out-of-state PAC; or

• a document listing the committee’s name, address and phone number; the name of the person appointing the committee’s campaign treasurer; and the name, address and phone number of the committee’s campaign treasurer.

NOTE: If your committee accepted contributions from an out-of-state PAC and you do not enter the FEC # or attach a PDF copy of the required information, you must timely file a paper copy of the required information at the time you file your electronic report.

Itemize box: Checking this box indicates that this in-kind contribution will be itemized on Schedule A2. The automatic default is to itemize. You are required to itemize any non-monetary contribution made electronically and itemize contributions that exceed the Itemization Threshold (in the aggregate) from a single contributor. If your committee accepted two or more contributions from the same contributor, the total of which exceeded the Itemization Threshold, enter each contribution separately and be sure the box is checked for each entry.

Contributor Employer and Occupation Information (These fields will be activated only if "Individual" is selected for the type of contributor.)

SPAC: Schedule B

As always, you must disclose a pledge on Schedule B in the reporting period in which your committee accepted the pledge. Effective January 1, 2015, you must also disclose the receipt of the pledged contribution on Schedule A1 (used for monetary contributions) or A2 (used for non-monetary contributions), as applicable, in the reporting period in which your committee actually receives the pledged money or thing of value. If the pledge is accepted and received in the same reporting period, it is no longer a pledge disclosed here; it becomes a contribution disclosed on the applicable contributions schedule.

Schedule B is used to itemize pledges (monetary or in-kind) that exceed the Itemization Threshold (see Contribution Itemization Thresholds Table above) from one person during the reporting period.

If your committee accepted monetary incoming funds (such as contributions, loans, or interest) or received non-monetary (in-kind) contributions, enter them on the applicable schedules associated with the categories shown on the Worksheet Summary page.

Notice to Candidates and Officeholders: If your committee makes political expenditures or accepts political contributions in support of a candidate or officeholder, your committee must provide written notice to the candidate or officeholder who benefits from the committee's activity. The notice must be given before the end of the reporting period during which your committee made the political expenditures or accepted the political contributions. The notice must inform the person that the committee has made political expenditures or accepted political contributions on his or her behalf, and include the full name and address of the political committee and its campaign treasurer and an indication that the committee is a specific-purpose committee. NOTE: Such notices are not required if the committee is the principal political committee of a political party.

Corporate or Labor Organization Pledged Contributions: Do not enter on this schedule pledged contributions your committee accepted from corporations or labor organizations. Only a specific-purpose committee that supports or opposes measures exclusively may accept contributions from corporations or labor organizations and must report such contributions on Schedules C1, C2, and D. If a committee supports or opposes a candidate or assists an officeholder, the committee may not accept corporate or labor organization contributions.

Pledge of Personal Services or Travel: You are not required to include pledges of an individual’s personal services or travel if the individual receives no compensation from any source for the services.

Pledged Contributions List: After you enter your first pledged contribution, the filing application will begin a list of all contributions entered on Schedule B for this report. The list will display pertinent information for each contribution:

The pledged contributions list will be the first screen you see each time you return to this schedule. From this list, you will be able to

Contributions from Out-of-State Political Committees (These fields will be activated only if "Entity" is selected for the type of contributor.)

Is the Contributor an out-of-state PAC? Check this box only if the contributor is an out-of-state political committee (PAC). Certain restrictions apply to contributions from out-of-state PACs. The fact that a political committee has a mailing address outside of Texas does not mean that the committee is an out-of-state PAC for purposes of these restrictions. A political committee that has a campaign treasurer appointment on file in Texas is NOT an out-of-state PAC. A political committee that makes most of its political expenditures outside of Texas may be an out-of-state PAC. A political committee must determine if it is an out-of-state PAC.

PAC FEC #: If the out-of-state PAC is registered with the Federal Election Commission (FEC), enter the PAC’s FEC identification number (FEC #).

If you do not have an FEC # for the out-of-state PAC, you must provide other documentation as explained below.

Browse to Upload PDF. Attach a copy of one of the following required documents in PDF format to be included with your report:

If you accept

• a copy of the out-of-state PAC’s statement of organization filed as required by law with the Federal Election Commission (FEC) and certified by an officer of the out-of-state PAC; or

• a written statement, certified by an officer of the out-of-state PAC, listing the full name and address of each person who contributed more than the Out-of-state PAC Contributions TO Threshold** to the out-of-state PAC, as defined in the "Out-of-State PAC Contribution Thresholds" table above, during the 12 months immediately preceding the contribution.

If you accept

• a copy of the out-of-state PAC’s statement of organization filed as required by law with the Federal Election Commission (FEC) and certified by an officer of the out-of-state PAC; or

• a document listing the committee’s name, address and phone number; the name of the person appointing the committee’s campaign treasurer; and the name, address and phone number of the committee’s campaign treasurer.

NOTE: If your committee accepted contributions from an out-of-state PAC and you do not enter the FEC # or attach a PDF copy of the required information, you must timely file a paper copy of the required information at the time you file your electronic report.

Itemize box: Checking this box indicates that this pledge will be itemized on Schedule B. The automatic default is to itemize. You are required to itemize pledges that exceed the Itemization Threshold (in the aggregate) from a single contributor. If you accepted two or more pledges from the same contributor, the total of which exceeded the Itemization Threshold, enter each pledge separately and be sure the box is checked for each entry.

Contributor Principal Occupation and Employer Information (These fields will be activated only if "Individual" is selected for the type of contributor.)

SPAC: Schedule C2

Schedules C1 and C2 are only for specific-purpose committees that support or oppose measures exclusively. Such committees also use Schedule D to disclose corporate or labor organization pledged contributions. If a committee supports or opposes a candidate or assists an officeholder, the committee may not accept corporate or labor organization contributions.

Schedule C2 is used to itemize all non-monetary (in-kind) political contributions accepted from corporations or labor organizations during this reporting period. You must itemize all such corporate or labor organization non-monetary (in-kind) contributions, regardless of the amount, on this schedule. If your committee accepted other types of incoming funds or activity (such as monetary contributions, pledges, loans, or interest) enter them on the applicable schedules associated with the categories shown on the Worksheet Summary page.

Non-Monetary Contributions List: After you enter and save your first non-monetary (in-kind) corporate or labor organization contribution, the filing application will begin a list of all contributions entered on Schedule C2 for this report. The list will display pertinent information for each contribution:

The non-monetary contributions list will be the first screen you see each time you return to this schedule. From this list, you will be able to

Itemize box: This box is always checked on this schedule. Your committee is required to itemize all non-monetary (in-kind) contributions from corporations and labor organizations, regardless of the amount. If your committee accepted two or more in-kind contributions from the same corporate contributor, enter each in-kind contribution separately.

SPAC: Schedule D

Schedule D is only for specific-purpose committees that support or oppose measures exclusively. Such committees also use Schedules C1 and C2 to disclose corporate or labor organization monetary and non-monetary (in-kind) contributions. If a committee supports or opposes a candidate or assists an officeholder, the committee may not accept corporate or labor organization contributions.

As always, you must disclose a corporate or labor organization pledge on Schedule D in the reporting period in which your committee accepted the pledge. Effective January 1, 2015, you must also disclose the receipt of the pledged corporate or labor organization contribution on Schedule C1 (used for monetary corporate or labor organization contributions) or C2 (used for non-monetary corporate or labor organization contributions), as applicable, in the reporting period in which your committee actually receives the pledged money or thing of value. If the pledge is accepted and received in the same reporting period, it is no longer a pledge disclosed here; it becomes a contribution disclosed on the applicable contributions schedule.

Schedule D is used to itemize all pledges (monetary or in-kind) from corporations or labor organizations accepted by your committee during the reporting period. You must itemize all such corporate or labor organization pledges, regardless of the amount, on this schedule. If your committee accepted other types of incoming funds or activity (such as monetary contributions, non-monetary (in-kind) contributions, corporate or labor organization support, loans, or interest) enter them on the applicable schedules associated with the categories shown on the Worksheet Summary page.

Pledge of Personal Services or Travel: You are not required to include pledges of an individual’s personal services or travel if the individual receives no compensation from any source for the services.

Pledged Contributions List: After you enter your first pledged contribution from a corporation or labor organization, the filing application will begin a list of all contributions entered on Schedule D for this report. The list will display pertinent information for each contribution:

The pledged contributions list will be the first screen you see each time you return to this schedule. From this list, you will be able to

SPAC: Schedule F2

Enter only expenditure obligations that your committee has incurred but not yet paid on Schedule F2. (Political expenditures that were paid in this reporting period are disclosed on Schedule F1. Non-political expenditures that were paid in this reporting period are disclosed on Schedule I.) Expenditures made by credit card are disclosed on schedule F4 (used for expenditures made by credit card).

Effective January 1, 2015, you must also disclose when your committee actually pays the incurred expenditure. You must disclose the outgoing payment on Schedule F1 or I, as applicable, in the reporting period in which your committee pays the expenditure.

Expenditures Made By Credit Card: Effective September 1, 2015, you must disclose committee expenditures charged to a credit card on Schedule F4 and not on this schedule. When your committee pays the credit card bill, you will disclose the payment to the credit card company on the appropriate disbursements schedule. See Expenditures Made by Credit Card for more information.

Schedule F2 is used to itemize political expenditures your committee has incurred but not yet paid that exceed the Expenditure Threshold to one individual or entity during the reporting period.

Also use this schedule to itemize any non-political expenditures your committee has incurred but not yet paid during the reporting period, regardless of the amount. If your committee had other outgoing funds (such as investment purchases or political payments from political funds), or expenditures made by credit card, enter them on the applicable schedules associated with the categories shown on the Worksheet Summary page.

Notice to Candidates and Officeholders: If your committee makes political expenditures or accepts political contributions in support of a candidate or officeholder, your committee must provide written notice to the candidate or officeholder who benefits from your committee's activity. The notice must be given before the end of the reporting period during which your committee made the political expenditures or accepted the political contributions. The notice must inform the person that your committee has made political expenditures or accepted political contributions on his or her behalf, and it must include the full name and address of the political committee and its campaign treasurer and an indication that the committee is a specific-purpose committee. NOTE: Such notices are not required if your committee is the principal political committee of a political party.

Important Restrictions Regarding The Use Of Political Funds To Rent Or Purchase Real Property

Reporting Tips to Avoid Common Pitfalls: Outgoing Expenditures

Unpaid Incurred Obligations List: After you enter and save your first unpaid incurred obligation, the filing application will begin a list of all unpaid incurred obligations entered on Schedule F2 for this report. The list will display columns showing pertinent information for each payee:

The unpaid incurred obligations list will be the first screen you see each time you return to this schedule. From this list, you will be able to

Tell Me More About Incurred Expenditure Obligations

Itemize box: Checking this box indicates that this incurred expenditure will be itemized on Schedule F2. The automatic default is to itemize. Your committee is required to itemize incurred political expenditures that exceed the Expenditure Threshold (in the aggregate) to a single payee. Your committee is required to itemize any non-political incurred expenditure, regardless of the amount. If your committee incurred two or more political expenditures to the same payee, the total of which exceeded the Expenditure Threshold, enter each incurred expenditure obligation separately and be sure the box is checked for each entry.

Expenditure Purpose. You must disclose the purpose of the expenditure in two parts: Category and Description. Merely disclosing the category of goods, services, or other thing of value for which the expenditure is made does not adequately describe the purpose of an expenditure.

Examples of Acceptable Ways to Report Expenditure Purpose

SPAC: Schedule F4

NEW! Effective February 1, 2023, all expenditures made by credit card must be listed with the name of the financial institution that issued the credit card used for the expenditure.

Effective September 1, 2015, you must disclose committee expenditures charged to a credit card on this schedule and identify the individual, entity, or vendor who receives payment from the credit card company. (When your committee pays the credit card bill, you will disclose the payment to the credit card company on the appropriate disbursements schedule.)

Schedule F4 is used to itemize expenditures your committee made by credit card that exceed the Expenditure Threshold to one individual or entity during the reporting period.

If your committee had outgoing funds (such as investment purchases or political payments from political funds), or obligations that your committee has incurred but not yet paid, enter them on the applicable schedules associated with the categories shown on the Worksheet Summary page. See Expenditures Made by Credit Card for more information.

Notice to Candidates and Officeholders: If your committee makes political expenditures or accepts political contributions in support of a candidate or officeholder, your committee must provide written notice to the candidate or officeholder who benefits from your committee's activity. The notice must be given before the end of the reporting period during which your committee made the political expenditures or accepted the political contributions. The notice must inform the person that your committee has made political expenditures or accepted political contributions on his or her behalf, and it must include the full name and address of the political committee and its campaign treasurer and an indication that the committee is a specific-purpose committee. NOTE: Such notices are not required if your committee is the principal political committee of a political party.

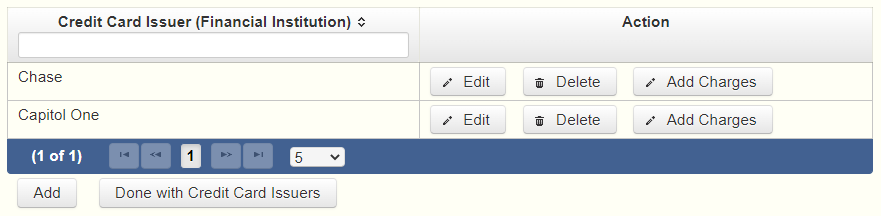

NEW! Credit Card Issuer: Before any Schedule F4 Expenditure can be added to the report, the name of the financial institution that issued the credit card must be listed in the

NEW! Financial Institutions List: After you have entered at least one financial institution, you can begin adding specific expenditure information for each transaction for each credit card used.

From this list, whenever you need to add any expenditures made by credit card, you would click the

Note: If you delete a credit card issuer ALL expenditures listed with that credit card issuer will be deleted.

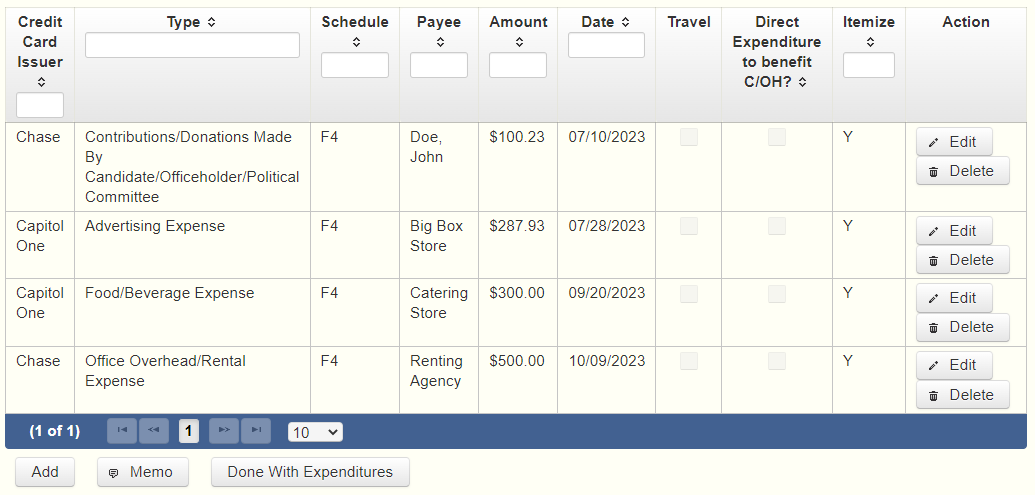

Expenditures Made By Credit Card List: After you enter and save your first expenditure made by credit card, the filing application will begin a list of all credit card expenditures entered on Schedule F4 for this report. The list will display columns showing pertinent information for each payee:

The expenditures made by credit card list will be the first screen you see each time you return to this schedule. From this list, you will be able to

You can also sort the list in ascending or descending order by clicking on the column header in which you are interested or search the list by entering the search word in the field at the top of each column. You may also use the

Note: Disclose the name of the vendor who sold you the goods or services as the payee, NOT the credit card company.

Note: There is a special reporting rule for expenditures made by credit card. For reports due 30 days and 8 days before an election (pre-election reports) and for runoff reports, the date of the credit card expenditure is the date the credit card is used. For other reports, the date of the credit card expenditure is either the date of the charge or the date the credit card statement is received. A filer can never go wrong by disclosing the date of the expenditure as the date of the charge. See Reporting Tips to Avoid Common Pitfalls: Outgoing Expenditures for more information.

Expenditure Purpose. You must disclose the purpose of the expenditure in two parts: Category and Description. Merely disclosing the category of goods, services, or other thing of value for which the expenditure is made does not adequately describe the purpose of an expenditure.

Note: Do not select “Credit Card Payment” as the category for an expenditure made by credit card when an individual, entity, or vendor receives payment from the credit card company. Instead, select the category that corresponds to the goods, services, or other thing of value purchased from the individual, entity, or vendor.

NEW!

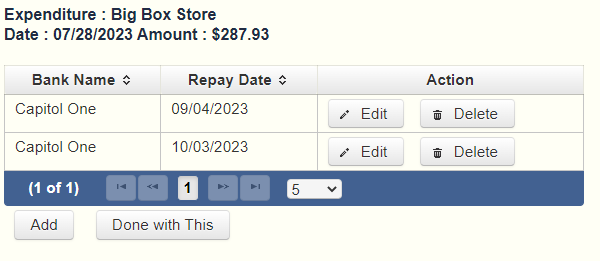

NEW! COH: Schedule F4 – CCI Repayment Date(s)

Date(s) Payments Made to Credit Card Issuer for this Charged Expenditure. This page will let you list ALL (if any) of the date(s) within the reporting period which you made repayments to the credit card issuer for this expenditure. You will not need to list any of the repayment amounts, only the repayment dates.

Repayment List: will show all repayment dates listed for the current expenditure. The page will state the name of the expenditure's payee, the expenditure date, and the amount of the expenditure above the list.

You can click on the

SPAC: Schedule Subtotals

Schedule Subtotals is a new page of the reporting form intended to supplement the report totals (cover sheet, page 2). This page displays the calculated Subtotal for each report schedule, based on the amounts you entered on the schedule entry screen (reported itemized and reported unitemized) and any other unitemized total you enter as a lump sum amount here (user entered lump sum unitemized).

You are always required to itemize or report detailed information for contributions, expenditures, and loans over a certain monetary threshold. The thresholds vary depending on the type of activity (see "Itemization Thresholds" below). For smaller contributions, expenditures, and loans that do not exceed the threshold (in the aggregate from a single source), you may report them in one of two ways: 1) add them all together and enter the unitemized total as a lump sum; OR 2) enter the detailed information on the schedule entry screen (and choose to itemize or not).

Itemized transactions: You chose to enter the detailed information on the schedule entry screen AND the "itemize" box is checked. The filing application calculates the sum of the entries for each schedule and the amount is displayed in the Reported Itemized column for the applicable schedule.

Unitemized transactions: Depending on your choice of entry, your unitemized transactions are shown under one of the following columns:

Itemization Thresholds for Each Schedule: To return to the instructions for each schedule, click on the applicable link below.

Monetary Political Contributions (A1) – You are not required to itemize contributions (in the aggregate from a single source) that are less than or equal to the

Monetary Contributions from Corporation or Labor Organization (C1) – This schedule is only for political committees that support or oppose measures exclusively. There is no itemization threshold for this schedule. You must itemize all monetary contributions from a corporation or labor organization.

Loans (E) – You are not required to itemize loans (in the aggregate from a single source) that are less than or equal to the

Interest, Credits, Gains, Refunds, and Contributions Returned to Filer (K) – You are not required to itemize such activity (in the aggregate from a single source) that are less than or equal to the

Political Expenditures from Political Contributions (F1) – You are not required to itemize political expenditures (in the aggregate from a single source) that are less than or equal to the

Payment from Political Contributions to the Business of C/OH (H) – There is no itemization threshold for this schedule. You must itemize all such payments.

Non-political Expenditures from Political Contributions (I) - There is no itemization threshold for this schedule. You must itemize all non-political expenditures from political contributions.

Purchase of Investments from Political Contributions (F3) – You are not required to itemize investments (in the aggregate from a single source) that are less than or equal to the investment itemization threshold. You are not required to enter a lump sum for this schedule. Refer to the "Investment Itemization Thresholds" table:

In-kind Political Contributions (A2) – You are not required to itemize contributions (in the aggregate from a single source) that are less than or equal to the contribution itemization threshold. If not entered on this schedule, you must enter a lump sum. Refer to the "Contribution Itemization Thresholds" table above.

Pledged Contributions (B) – You are not required to itemize pledges (in the aggregate from a single source) that are less than or equal to the contribution itemization threshold. If not entered on this schedule, you must enter a lump sum. Refer to the "Contribution Itemization Thresholds" table above.

Non-monetary (in-kind) Contributions from Corporation or Labor Organization (C2) - This schedule is only for political committees that support or oppose measures exclusively. There is no itemization threshold for this schedule. You must itemize all non-monetary contributions from a corporation or labor organization.

Pledged Contributions from Corporation or Labor Organization (D) - This schedule is only for political committees that support or oppose measures exclusively. There is no itemization threshold for this schedule. You must itemize all monetary and non-monetary pledges from a corporation or labor organization.

Unpaid Incurred Obligations (F2) – You are not required to itemize incurred but not yet paid political expenditures (in the aggregate from a single source) that are less than or equal to the expenditure itemization threshold. If not entered on this schedule, you must enter a lump sum. You are required to itemize all incurred but not yet paid non-political expenditures, regardless of the amount. Refer to the "Expenditure Itemization Thresholds" table above.

Expenditures Made by Credit Card (F4) – You are not required to itemize political expenditures made by credit card (in the aggregate from a single source) that are less than or equal to the expenditure itemization threshold. If not entered on this schedule, you must enter a lump sum. You are required to itemize all non-political expenditures made by credit card, regardless of the amount. Refer to the "Expenditure Itemization Thresholds" table above.

SPAC: Out-of-State Travel Information

Non-monetary (In-kind) Contribution or Political Expenditure for Travel Outside of Texas: In addition to the required information you enter on the applicable political contribution or expenditure schedule, the description of an in-kind contribution, in-kind pledge, or political expenditure for travel outside of the state of Texas must include other detailed information. The required additional detailed information you enter on this screen will be included in your report on Schedule T.

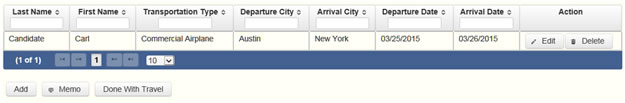

Travel Information List: After you enter and save additional travel information for an in-kind contribution, in-kind pledge, or political expenditure, the filing application will begin a list of all travel information entered for each in-kind contribution, in-kind pledge, or expenditure. The filing application will display the name of the contributor or payee, as applicable, the date, and the amount of the in-kind contribution, in-kind pledge, or expenditure for which you are entering detailed travel information. The list will display columns showing pertinent information for each travel entry:

The travel information list will be the first screen you see each time you return to this schedule. From this list, you will be able to

Note: At the top of the entry screen, the filing application will display the name of the contributor or payee, as applicable, the date, and the amount of the in-kind contribution, in-kind pledge, or expenditure for which you are entering additional travel information. If you need to enter travel information for a different in-kind contribution, in-kind pledge, or expenditure, check the “Expenditure for Out of State travel” box on the entry screen for the in-kind contribution, in-kind pledge, or expenditure that you wish to edit, and click on the Enter Travel Info button that activates when you check the box.

SPAC: Direct Expenditures – Candidate Information

Direct Expenditure to Benefit a Candidate/Officeholder: If your committee made a direct campaign expenditure payment to benefit another candidate or officeholder, you must include additional information about the candidate/officeholder. Do not complete this section if the expenditure was not a direct campaign expenditure.

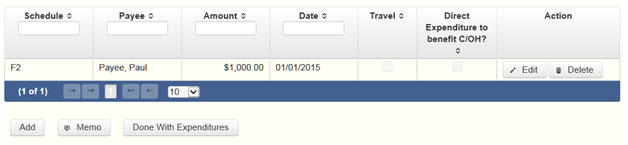

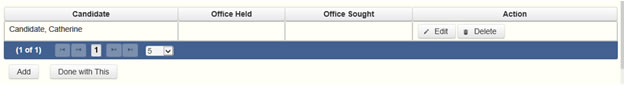

Direct Expenditure Candidate Information List: After you enter and save candidate information for a direct campaign expenditure, the filing application will begin a list of all the candidate information entered for this expenditure. The filing application will display the payee name, date, and amount of the expenditure for which you are entering detailed candidate information. The list will display columns showing pertinent information for each candidate information entry:

The direct expenditure candidate information list will be the first screen you see each time you return to the “Enter Candidate Info” entry screen. From this list, you will be able to

Note: At the top of the entry screen, the filing application will display the payee name, date, and amount of the expenditure for which you are entering detailed candidate information. If you need to enter candidate information for a different direct campaign expenditure, check the “Direct Expenditure to Benefit C/OH” box on the entry screen for the expenditure that you wish to edit, and click on the Enter Candidate Info button that activates when you check the box.

SPAC: Report Totals (Cover Sheet, Page 2)

You are required to include in your campaign finance report the following total amounts of contributions, expenditures, and loans:

The law requires you to disclose the total amount of political contributions accepted, including interest or other income on those contributions, maintained in one or more accounts in which political contributions are deposited as of the last day of the reporting period.

The "total amount of political contributions maintained" includes: the total amount of political contributions maintained in one or more accounts, including the balance on deposit in banks, savings and loan institutions and other depository institutions; the present value of any investments that can be readily converted to cash, such as certificates of deposit, money market accounts, stocks, bonds, treasury bills, etc.; and the balance of political contributions accepted and held in any online fundraising account over which the filer can exercise control by making a withdrawal, expenditure, or transfer.

SPAC: Report Error Check

Report Error Check is a tool to assist you in fulfilling your reporting requirements. The Error Check details errors and omissions in the data entry; it does not verify that the report has satisfied all legal requirements. You should review the applicable TEC Guide and the filing application PAGE HELP to ensure that ALL required information is included before you file your report.

If the Error Check finds errors in your report, the errors will be listed for you in a table on this screen. You can also click the

The errors list includes the following information:

SPAC: Correction Affidavit

A filer who files a corrected report must submit a Correction Affidavit. The affidavit must identify the information that has changed. The affidavit also provides check boxes for your use in swearing to certain statutory provisions regarding the corrected report, if applicable.